Looking to apply for an IPO? In this article I explain about the best stock broker for an IPO investment and their advantages.

I apply for IPOs both for listing day gain and for long term investments. IPOs provide excellent opportunity for value investors as shares of quality companies seldom trade below the listing price in secondary market.

However, it is not only important to identify good companies coming up with Initial Public Offerings (IPO), it is also necessary to identify best stock broker for IPO investment in India in 2026. A superior broker will provide all the necessary infrastructure and support for applying IPOs.

In this article, I am listing some of them which in my view are finest stock brokers as far as investing in IPO is concerned.

Before that, let me explain different ways to invest in IPOs so that you are sure if the broker supports the method you prefer for applying for IPO.

How to Apply for IPO Online?

One can apply for IPOs both in Offline and Online method. We are not going to discuss about offline process in this post.

Nowadays most of the transactions happens through online and hence I will explain more about online method.

Basically there are two ways for applying for IPOs online in India.

- Through ASBA route

- Through UPI

Before July 2019, it was not possible to place IPO application directly with a broker. One had to use their bank’s netbanking portal, fill out online form and provide his/her demat account number in the application form. This is called ASBA process of IPO application.

But thanks to SEBI’s implementation of UPI Interface for IPO, now we can apply directly through broker through UPI method. You can use BHIM UPI or any other UPI App to apply for IPO.

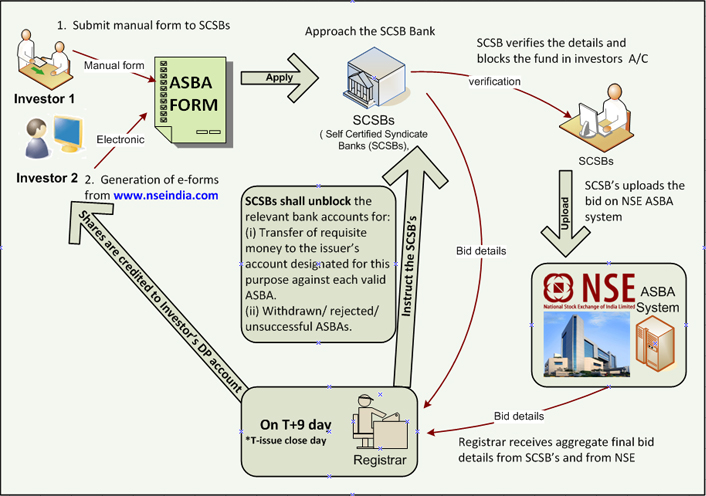

ASBA Method for applying IPO:

ASBA stands for Application Supported by Blocked Amount. In this method, One need to apply through banks for the required quantity by using netbanking portal. Application can also be submitted in physical (manual) form by visiting the bank.

The corresponding funds are blocked in savings account until the entire IPO process is completed. Funds will be released only if there is no allotment. In case of partial allotment, corresponding amount is released.

During the entire process, the funds does not leave your bank account but it is only blocked for allotment. Hence the money will continue to earn interest.

While applying through ASBA route, you need to provide your demat account number. One can provide any of your demat account number (If you have two demat accounts say with stock broker A and B, you can choose any of them).

So it is important to note that, demat account is mandatory for applying to IPO.

Applying for IPO through UPI

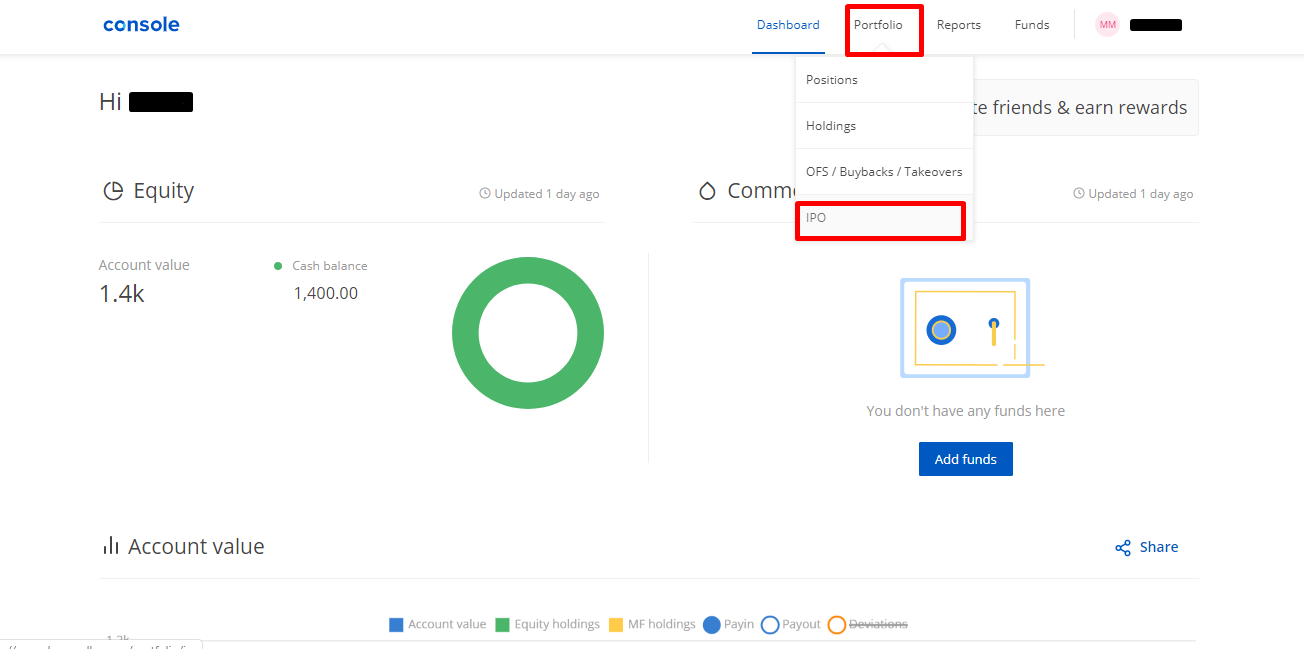

This method enables IPO investors to apply directly through their brokers without approaching the banks

The backend process is similar to ASBA where amount is blocked in bank account. But the front end will now have UPI Interface instead of netbanking portal of banks.

You need to open your broker console and apply for IPO. A mandate is pushed to your UPI app and you need to accept the mandate.

What ever the method you choose for applying IPO online, one need to have a reliable stock broker for IPO investment. Let us discuss some of them now.

Ranking for Best Stock Broker For IPO Investment – 2026

As we know, demat account is mandatory to invest in IPO. So one need to select a good stock broker for IPO Investment.

Here is the list of best IPO brokers in India,

- 1. Zerodha Stock Broker for IPO Investment

- 2. Upstox Stock Broker for IPO Investment

- 3. 5Paisa Stock Broker for IPO Investment

- 4. Sharekhan Stock Broker for IPO Investment

- 5. ICICI Direct Stock Broker for IPO Investment

In above list , I have included three discount brokers, one full service broker and one bank based broker.

#1. Zerodha

I invest in quality IPO’s through Zerodha and I’m satisfied with their service. Hence I am placing them on top of the list of best broker for IPO investment in India.

I have written detail review about Zerodha in which I brought out why I switched from Sharekhan to Zerodha in 2012. Read the article here.

They are also largest stock broker of India having highest number of customers than any other stock broker.

One can apply for IPO in Zerodha through UPI method. It is easy and simple.

Zerodha’s trading platform KITE is considered as one of the best trading platform of India. You can apply to IPO by logging into the Zerodha KITE dashboard.

Brokerage charges of Zerodha is Zero for delivery trades, Rs20/trade for all other segments.

Below table has the detailed information about Zerodha brokerage charges.

It is easy to open account with Zerodha. It takes less than 15 minutes, completely online and 100% paperless.

Related Read: Step by step guide for opening account with Zerodha

Zerodha Account Opening Charges:

- Online through Aadhaar : Rs 200

- Offline by submitting forms : Rs 400

SaveRs200: you can save Rs200 by opening the account online. Use below Link to save Rs 200.

#2 Upstox

Upstox is second biggest discount stock broker after Zerodha. They are based out of Mumbai.

Upstox is backed by some of the well known investors like Mr. Ratan Tata. Upstox demat account is one of the best demat account in India for applying IPO and to invest in top rated companies during IPO.

For more information about Upstox, read this detailed review.

You can apply to IPOs with Upstox through UPI route. You can also take ASBA route with banks and then provide your demat account number (dp id + beneficiary account number) with Upstox.

Below table has the information of Upstox Brokerage charges,

Details of Upstox account opening charges,

Related Read: Upstox Vs Zerodha

Use below button to open account with Upstox.

#3 5Paisa

5Paisa is discount brokerage arm of India Infoline (IIFL). IIFL is a leading full service broker and into the brokerage industry since 2 decades.

To know more information about 5Paisa and their offerings, read this review.

Previously, 5Paisa used to charge Rs10/trade but now they have increased it to Rs20/trade. Unlike Zerodha, they do not offer free delivery trades.

Related Read: 5Paisa Vs Zerodha

Below is the detailed information about 5Paisa brokerage charges,

And below are the account opening and AMC charges of 5Paisa,

Use the below button to avail the promocode of Zero account opening charges,

#4 Sharekhan

Sharekhan is third largest stock broker after Zerodha and ICICI Direct. They are the largest full service broker.

Sharekhan offers wide range of products like equities, F&O, Currencies and Commodities. Apart from regular products mentioned above, they also offer customised service like Portfolio Management Service (PMS) . But they expect minimum investment of 50Lakhs.

To know more about Sharekhan, their brokerage charges and platforms offered etc, read this detailed review.

Again, IPO investors can choose UPI route to apply for upcoming IPOs.

But at Sharekhan, brokerage charges are very high. This makes them not suitable for traders who trade frequently.

Below table shows the brokerage charges of Sharekhan,

Sharekhan currently offering Zero account charges. Also, there is no AMC charges for first year.

#5 ICICI Direct

ICICI Direct is the brokerage unit of ICICI Bank which is one of the major private sector bank of India.

They are the second broker to have highest number of customers. To know more about ICICI Direct, read the detailed review.

Since ICICI Direct is linked to ICICI Bank, one can directly apply to IPO from ICICI Direct dashboard. Corresponding funds are blocked in ICICI Savings bank account.

In this process, UPI process is not involved.

ICICI Direct is the most expensive broker of India. They charge on per lot basis in Options which makes it nearly impossible to implement any options strategies.

Below table captures the brokerage charges of ICICI Direct

ICICI Direct currently offering Zero account charges. However the AMC charges are on higher side.

Best Stock Broker for IPO Investment – Conclusion

Most of the brokers in India enable investing in IPOs, but their platforms have severe technical glitches and you need to contact their customer care team many times to resolve the issue. I myself have gone through this.

Hence, in the above list of best stock broker for IPO investment I have included only the top brokerage firms of India.

These best online brokers for IPO have the smooth IPO investment flow, have robust platforms and you don’t have to worry about any issues. The demat account offered by them is the will be best for IPO investment.

But I suggest you to consider discount brokers like Zerodha or Upstox. That is because once you have allotment and got share credited to your demat account, you need to sell them on listing day or at some point of time.

These brokers have Zero brokerage for delivery segment and hence you will save huge amount in terms of brokerage.

For example, If you got allotment of shares worth Rs 1 lakh and sell them through ICICI Direct, with 0.55% you will pay Rs 550 brokerage. This amount can be saved by just switching to a discount broker.

So, I consider Zerodha as best broker for IPO investment in India. Please share your thoughts.

You May Also Like To Read :

- 10 Best Discount Brokers of India who can reduce your trading costs significantly

- 6 Stock Brokers of India well suited for Options trading

- 5 Best Stock Brokers for Day trading (Intraday trading) in India

- Top 7 Commodity brokers of India to trade in Commodity Segment

- 10 Leading Brokers who provide High Margin and also Low Brokerage

- Stock Brokers Who are Known For their Best Customer Service in India

- List of Stock Brokers having Highest Active Clients in India

- Tool to do Side By Side Comparison of Any Two Stock Brokers of India

- Find the Best Stock Broker In Your City

- How to Choose the Best Stock Broker In India as per your Requirement

You should also consider Latest Grey Market Premium (GMP) of all the upcoming IPOs if you are interested in making handsome gain on listing day.

GMP indicates the premium above issue price the IPO is trading in grey or unofficial market. I do not recommend to deal in grey market and myself also does not participate in that.

It is just to gauge the sentiment of the market about the company coming up with the IPO issue.